How Much Does Flood Insurance Cost . Older homes built before modern construction. Residents in coastal states tend to buy flood insurance policies in much higher numbers.

Flood Insurance Cost Calculator Find Average Cost Of Flood Insurance from dta0yqvfnusiq.cloudfront.net Several factors determine flood insurance cost including flood risk, coverage type, the design and age of your structure, and more. Flood insurance rates are rising. There is little one can do to stop the flood from wrecking one's home as a hurricane passes by. The cost of a flood insurance policy. Your insurance agent can help you get a policy that covers you, or you can contact the national flood insurance program's help center;

How is flood insurance different from homeowners insurance? How much does flood insurance cost? The cost of a flood insurance policy. There is little one can do to stop the flood from wrecking one's home as a hurricane passes by. Residents in coastal states tend to buy flood insurance policies in much higher numbers. In addition, you need to decide if you want to insure. How much flood insurance should cost.

Source: www.savings.com.au How much is renters flood insurance? How much flood insurance should cost. Putting flood insurance costs in perspective. How much does flood insurance cost?

Does anyone know how much insurance will increase by after getting 6 points? How much is flood insurance on average? Private flood insurance through companies like allstate as flood experts, everyone asks us how much should flood insurance cost? the flood nerds at better flood think you should pay as little as. What is the national flood insurance program (nfip)?

While the best way to know how much your flood insurance will cost flood insurance providers also pay close attention to how your home is constructed and how old it is. Flood insurance rates are rising. It depends on the size and structure of your house and the value of your possessions. Where to get flood insurance.

Source: res.cloudinary.com According to blust, one inch of flood damage alone can cost a household up to $20,000. There are several factors to determine how much flood insurance will cost you. What impacts flood insurance policy costs? Simply because those areas are not ones where rising water tends to accumulate.

How much does not having flood insurance cost? How much is renters flood insurance? How much does flood insurance cost? Floods are the nation's most common disaster, and also the costliest, according to the federal emergency management agency (fema) and ready.gov (the.

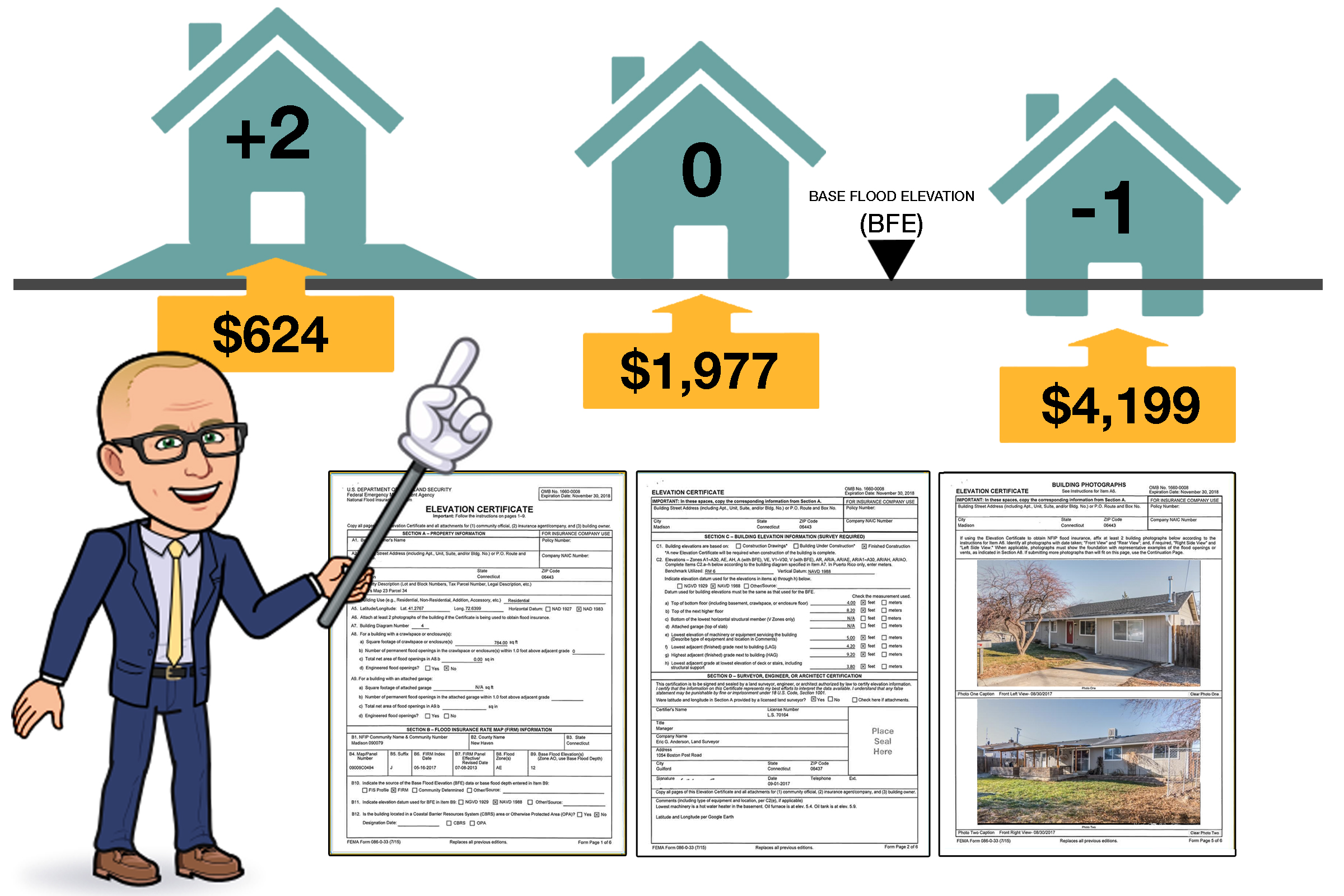

A number of factors are considered when determining your annual flood insurance premium. The cost of a flood insurance policy. While the best way to know how much your flood insurance will cost flood insurance providers also pay close attention to how your home is constructed and how old it is. While flood insurance premium costs depend mostly on a property's risk level according to government mapping data, there are other factors that can contribute to the pricing of a flood insurance policy.

Source: assets.themortgagereports.com How much does flood insurance cost? How much is renters flood insurance? A standard home insurance policy does not cover flooding. You have to take out a separate flood insurance policy on top of your homeowner's policy.

Learn more about flood insurance and how to purchase flood insurance coverage. With so many factors to worry about, your likelihood of experiencing water damage is much higher than the risk of other problems for instance, how high risk the area in which you live is will affect the cost of your insurance. Standard homeowners' insurance, including umbrella coverage, typically does not include flood insurance. Your insurance agent can help you get a policy that covers you, or you can contact the national flood insurance program's help center;

It depends on the size and structure of your house and the value of your possessions. While flood insurance premium costs depend mostly on a property's risk level according to government mapping data, there are other factors that can contribute to the pricing of a flood insurance policy. Where to get flood insurance. Does purchasing flood insurance coverage still make sense for you?

Source: quotewizard.com How much you have to pay for flood insurance will vary based on the risk of where you live, how high your house is above ground level, and other factors. Personal property coverage is for your personal belongings. Valuepenguin.com broke down the costs of flood insurance by states, with monthly flood premiums ranging from as much as $101 per month in rhode island to as much as little as $38 per month in florida. Do you need flood insurance?

A number of factors are considered when determining your annual flood insurance premium. How much does flood insurance cost? In addition, you need to decide if you want to insure. Several factors determine flood insurance cost including flood risk, coverage type, the design and age of your structure, and more.

How is flood insurance different from homeowners insurance? Do you need flood insurance? Building coverage pays for damage to the structure, internal systems (like electric and plumbing), hvac systems, and appliances. Flood insurance rates are rising.

Source: www.houselogic.com With so many factors to worry about, your likelihood of experiencing water damage is much higher than the risk of other problems for instance, how high risk the area in which you live is will affect the cost of your insurance. How much does flood insurance cost? While the best way to know how much your flood insurance will cost flood insurance providers also pay close attention to how your home is constructed and how old it is. However, flood insurance rates vary greatly depending on your rating factors.

The nfip's premium increases will affect policyholders of all risk classes nationwide. How much does flood insurance cost? (most aaa homeowners insurance policies offer flood emergency assistance, which pays up to $3,000 for additional living expenses if the average flood insurance policy can cost approximately $700 per year, although the cost depends on where you live. According to blust, one inch of flood damage alone can cost a household up to $20,000.

According to blust, one inch of flood damage alone can cost a household up to $20,000. Your insurance agent can help you get a policy that covers you, or you can contact the national flood insurance program's help center; The average federal flood insurance policy costs about $700 a year, with rates depending on your location and type of structure. Do you need flood insurance?

Thank you for reading about How Much Does Flood Insurance Cost , I hope this article is useful. For more useful information visit https://thesparklingreviews.com/

Post a Comment for "How Much Does Flood Insurance Cost"